Curing adhesive market forecast at $10.7 billion by 2028

New York, NY – The curing adhesives market is projected to witness healthy growth during the forecast period, 2021–2028. The market was valued at USD 6,132.73 million in 2020 and is projected to register a CAGR of 7.76% to reach USD 10,795.82 million by the end of 2028 according to Market Research Future.

Curing adhesives are reactive materials that require chemical reactions to convert them from liquid (or thermoplastic) to solid. Once cured, these adhesives generally provide high strength, flexible to rigid bond lines that resist temperature, humidity, and many chemicals.They help to improve assembly time and costs. They have a high range of elasticity and are suitable for bondings with high requirements to the finished product’s aesthetics.

The increasing demand for curing adhesives is due to their growing applications in the electronics industry. Additionally, the growing application in the automotive assembly line and industrial goods is expected to drive the forecast period. Moreover, the technological dominance in the Asia-Pacific region is expected to create lucrative opportunities for the market.

Curing adhesives are used in the electronics manufacturing industry with ever-increasing frequency due to their properties and process advantages, which are a good fit for the manufacturing requirements that are demanded by the current electronic industry drivers, which includes environmental and health & safety demands, miniaturization, minimizing total product cost, and manufacturing yield improvement. They offer an ideal bonding for heat sinks and heat-sensitive components, wire and component tacking, strain relief of large parts, and securing hand-inserted components prior to wave soldering. Curing adhesives in the electronics manufacturing industry have found applications in wire and parts tacking, strain relief, tamper-proofing, coil terminating, temporary masking, structural bonding, encapsulation, potting, conformal coating, surface mount component attachment, and glob topping. Curing adhesives improves production rates without damaging sensitive electronic components and enables in-line testing, assembly, minimized handling, and increased product life. Recent innovations in the electronics industry, such as hybrid vehicles, mobile electronic devices, medical applications, digital cameras, computers, defense telecommunications, and augmented reality headsets, have led to the growth of curing adhesives, thus replacing many traditional soldering systems. The application of curing adhesive in the electronics industry acts as a dominant driving factor for the market.

However, these regulations and emission control systems by various governing bodies are expected to limit or hamper the growth of the curing adhesives market in the coming years. For instance, according to the Massachusetts Department of Environmental Protection, under 310 CMR 7.18(30), it regulates the VOC emissions of adhesives, sealants, adhesive primers, sealant primers, and associated surface preparation and cleanup solvents. In the European countries, REACH has laid down some of the regulations for adhesives manufacturers, developed under FEICA’s use maps. FEICA is a multinational association representing the European adhesive and sealant industry.

The outbreak of COVID-19 across regions has resulted in the lockdown of cities, breakdown of transportation networks, and border restrictions. This is estimated to significantly affectthe chemicals & materials network of distribution and the complete pricing, international trade, manufacturing operations, and supply chainacross the globe. Concurring, to the International Monetary Fund, the economic uncertainty owing to the COVID-19 outbreak is higher than the past pandemic outbreaks, including the severe acute respiratory syndrome (SARS), swine flu, avian flu, Ebola, and bird fludue to the escalating number of infected people and ambiguity about the timelessness of the crisis and when it is likely to come to a halt.

The manufacturing and supplying of curing adhesiveshavedecreasedduring theCOVID-19pandemic due to the halting of operations or shuttingdown of themanufacturing and operating facilities of the major market players. Some of them operate theirfacilities below theirideal level of production. However, they do notmeet the demand forthe product in the global market. The manufacturers have decreased their production capacities due to reduced prices, disruptions in the supply of raw materials, and a decline in demand from the end-use industries.

The manufacturers are also facing stern headwinds due to disruptions in the raw material supply and fluctuations in prices. Moreover, the companies are working intensely toward safeguarding its employees’ health and supporting government goals of maintaining critical business activities in power generation, food production, and healthcare.

The supply chain analysis is the process of comprehending the steps the stakeholders take in manufacturing and distributingcuring adhesivesthroughout the international market. The supply chain includes raw materials and suppliers, curing adhesivesproducers, distributors, and end-use industries.

Polymeric resins form the basic building blocks for any curing adhesives. The resins are mixed with various additives and curing materials in the resin mixture depending on the performance requirement. Additives help in reducing curing time, improve chemical & weather resistance, and increase operating temperature range. Some major resin manufactures include Huntsman Corporation, Olin Corporation, BASF SE, Hexion Inc., Dow Chemical, Covestro, Mitsui Chemicals, Evonik industries, and Shin-Etsu Chemical Co., Ltd.

The manufacturers have started R&D and investments in adhesives to satisfy the increasing demand for sustainable materials in the construction industry. For instance, in May 2021, Bostik acquired Edge Adhesives Texas, a manufacturer of hot-melt adhesives and pressure-sensitive adhesive tapes for residential construction. The acquisition helped Bostik to expand its offerings in high-performance adhesives in the US. Additionally, WACKER has launched the ELASTOSIL eco brand in Europe, thereby offering products manufactured using bio-based methanol to silicone sealant suppliers.

The distribution channel in this market comprises distributors, wholesalers, and e-commerce merchants. Generally, the distributors are engaged in long-term sales agreements with producers and end-users. The prevalence of e-commerce as a distribution channel is expected to increase over the forecast period with the penetration of technology and bolstering the growth of the e-commerce market across the world.The inductionof e-commerce is the latest trend in the market, offering on-door delivery and a competitive pricing edge. Players engaged in e-commerce are third-party online platforms, such as Alibaba, IndiaMART InterMESH Ltd, Amazon, etc.

The major end users of curing adhesives are the building & construction, electronics & electrical, automotive, and aerospace & defense industries. Furthermore, there was a rising use of curing adhesives in wind turbines and solar panels, which created a major trend in the curing adhesives market.

The global curing adhesives market has been segmented by resin, product type, application, and region.

Based on resin, the global market has been divided into acrylate, epoxy, polyurethane, silicone, and others. The acrylate segment accounted for the largest share of over 35% in 2020 due to its growing applications in the electronics sector.

By product type, the global curing adhesives market has been classified into moisture cure, UV cure, and heat/thermal cure. The moisture cure segment dominated the global curing adhesives market with a share of around 40% in 2020 due to their growth across the region, especially across the Asia-Pacific region.

The global curing adhesives market, based on application, has been classified into electronics & electrical, and others. The others segment dominated the global curing adhesives market with a share of over 70% in 2020 due to the growth of the industries across the globe. The other segment includes automotive, renewable energy, building & construction, and aerospace & defense industries.

Based on application, the global curing adhesives market, the others segment emerged as the leading and fastest-growing segment during the assessment period. The presence of major industries such as automotive, renewable energy, building & construction, and aerospace & defense industries are the main reason for the high demand in these applications coupled with the growing need for sustainable adhesives.

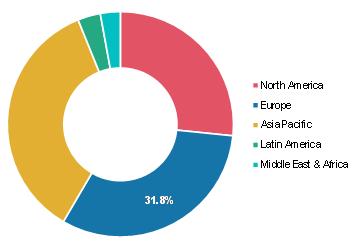

The global curing adhesives market has been divided into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

Asia-Pacific held the largest market share of 35.5% in 2020 due to the rapid industrialization and commercialization in the region. Furthermore, growing investments in infrastructure and electronics sectors have positively impacted the regional demand for curing adhesives in the region.

Europe held the second-largest market share of the global curing adhesives market in the year 2020. The regional market was valued at around USD 2,000 million in 2020. Germany held a larger market share of the regional market and is expected to register a higher CAGR during the review period.

North America is expected to witness significant demand for curing adhesives owing to its widespread applications in the renewable energy and construction industry. The US is the major contributor to the regional market growth in North America.

Key players operating in the global curing adhesives market include Henkel AG & Co. KGaA (Germany), Bostik (France), Sika AG (Switzerland), Dow (US), 3M (US), Wacker Chemie AG (Germany), H.B. Fuller (US), Dymax (US), Tosoh Corporation (Japan), DELO (Germany), Permabond LLC (UK), and Shin-Etsu Chemical Co., Ltd (Japan) among others.

Leading players in this market are H.B. Fuller, Henkel Adhesives, Dow, 3M, Bostik, Sika AG, Dymax, Tosoh Corporation, DELO, Permabond LLC, Wacker AG, and ShinEtsu Chemical Company. The manufacturers compete based on brand identity, product quality, and product cost. Vendors must offer cost-effective, environment-friendly, and high-quality products that adhere to the international quality standards of the industry as well as meet the environmental norms to compete in the market. The key players in the global curing adhesives market focus on growth such as mergers & acquisitions, product launches, expansion of the plant capacities on a global level to enhance their market share and become leaders in the global market.