Global thermoplastic elastomer market forecast with a CAGR of 7.2 percent by 2030

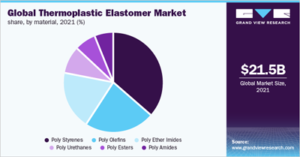

Pune, India – The global thermoplastic elastomer market size was valued at USD 21.45 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 7.2% from 2022 to 2030 according to Grand View Research. Increasing consumption across various applications such as automotive, electrical and electronics, industrial, medical, and consumer goods has been instrumental in the global industry growth over the last few years. Increasing demand in automotive component manufacturing is expected to be a major factor driving the global industry over the forecast period. Regulatory intervention by environmental agencies aimed at carbon emission reduction through an increase in fuel efficiency has forced major automotive OEMs to incorporate plastics as a substitute for metals and alloys in automotive components.

Increasing consumer preference for high-performance and lightweight passenger cars has been driving plastic innovation in automotive manufacturing. These factors have led to increased thermoplastics consumption in the aforementioned application. Thermoplastic elastomers (TPEs) exhibit superior physical and chemical properties compared to thermoset plastics, thus gaining preference in terms of application. High substitution rate of TPU and TPO as an alternative to ethylene propylene diene monomer (EPDM) in construction materials is expected to complement global industry demand over the forecast period.

TPEs are unique, eco-friendly thermoplastics that are not only recyclable but can also be re-molded and re-shaped, thereby eliminating wastage quite extensively. These offer various other advantages in terms of physical attributes and characteristics such as resistance to chemicals, UV, oxidation, and providing soft-touch to materials. These properties are increasingly driving rubber and conventional plastic material replacement by TPEs in their respective applications. Several federal bodies such as the FDA and US Pharmacopeia regulate product applications in numerous end-use industries to ensure utmost consumer health and safety. These regulations affirm TPE utilization for commercial applications by providing guidelines for prudent product usage.

The U.S. Environment Protection Agency (EPA) has also determined control techniques and guidelines regarding carbon emissions from various automotive vehicles, mentioned in the Clean Air Act, effective from October 2008. Thus, the corresponding demand for fuel-efficient cars and industrial machinery created from thermoplastic elastomer components has also increased. Rapidly developing automobile markets are also projected to boost the demand for thermoplastic elastomers in interiors, exteriors, sealing systems, and underhood components.

Thermoplastic Elastomer Market Trends

TPE facilitates increased fuel efficiency in automotive applications by lowering car weight and density by substituting conventional components inside and around the vehicle. To reduce the impact of carbon emissions and greenhouse gases (GHG) on the environment and human health, regulatory bodies across various nations have imposed numerous stringent regulations.

Rapidly developing automobile markets are also projected to boost TPE demand in exterior, interiors, sealing systems, and under-the-hood components. Increasing application in the automotive industry is spurred by demand for safe, lightweight, and inexpensive MUV/SUV models with high fuel efficiency and an emphasis on comfort and aesthetics.

Wearable electronics are among the most compelling new technologies that present opportunities for added connectivity, enhanced productivity, and enriched lifestyles. In many ways, these devices are an extension of the human body, expanding our capabilities and enabling us to communicate and interact with our environment and with others.

The development of unique wearable and miniaturized electronics has also contributed to market growth in recent years. Numerous electronic manufacturers have realized the benefits of integrating lightweight and sustainable materials such as TPE into wearable electronics to provide a non-tacky, soft-touch feel of advanced materials into high-end consumer gadgets.

Increasing expenditure on healthcare and medical facilities is expected to drive investments in medical devices such as plastic syringes, instruments, surgical gloves, and other plastic items utilized for consumer and industrial applications. This, in turn, has driven the demand for lightweight plastic materials such as TPE in these and other medical devices and products. Medicines and other pharmaceuticals are also utilizing these materials for packaging since they foster weight savings in transportation and allow hygienic protection of the inner contents.

Thermoplastic elastomers are prepared with various polymers depending on the grade or type of the desired end-product. TPE-S is two block copolymers with SBS rubber as the base element. TPO are blends of polypropylene (PP) and un-cross linked EPDM rubber, whereas TPV is also made of the same compounds with additional dynamic vulcanization.

Hence, raw materials differ based on prices and availability. However, since most plastic polymers are processed from crude oil, their prices are dependent on the global crude oil market and price trends. Crude oil is a commodity that sees large price fluctuations owing to supply and demand factors, natural disasters, seasonal variations, and other influencers, ultimately creating a price impact on its by-products such as plastic polymers.